tax act online stimulus check

Sign in to your Online Account If you dont have an existing IRS username or IDme account have your photo identification ready. The Economic Impact Payment EIP CARES Act or Stimulus Check Payment One was launched in April of 2020.

Instructions For Form 1040 Nr 2021 Internal Revenue Service

This payment is different than the Golden State Stimulus I GSS I.

. The popular Child Tax Credit plan which many compared to the stimulus checks sent out by the federal government during the height of. Line 16 on. Access your individual account information including balance payments tax records and more.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. You do not need to. Stimulus Check Payment One.

This includes deceased and incarcerated. In order to receive a check an incarcerated person must fill out an IRS Form 1040 with EIP 2020 written at the top and mail it to the IRS. Americas 1 tax preparation provider.

9 Bills You Should Never Put on Autopay. A Power of Attorney may be required for some Tax Audit Notice Services. But while it hasnt gotten as much attention as the relief stimulus checks the CARES Act has temporarily made employer student loan assistance payments tax-free through the end of 2020.

Christina at Unsplashwocintechchatco. And then when Trump signed the Covid-19 relief at the end of December 2020 it extended this benefit through 2025. Richmond to use state stimulus for school programs.

The 1400 stimulus check for Social Security recipients Delany said would be a way to get more tax -free income into the hands of seniors. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. 15 Worst States To Live on Just a Social Security Check Find.

The existing Child Tax Credit payment prior to the American Rescue Plan Act was worth 2000 per eligible child but only 1400 of the credit was refundable meaning those with less than 2000 in. This tool will provide an estimated payment amount based on the information you provide. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Approved State Stimulus and Rebate Check Programs. The act would send energy rebate payments of. To help struggling taxpayers affected by the COVID-19 pandemic the IRS issued Notice 2022-36 PDF which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns lateThe IRS is also taking an additional step to help those who paid these penalties already.

As a result of the Coronavirus Pandemic the US government has launched three stimulus check payments during 2020 and 2021. Had a California Adjusted Gross Income CA AGI of 1 to 75000 for the 2020 tax year. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Filed your 2020 taxes by October 15 2021. Maryland was the first state to enact a gas tax holiday suspending the 361 cents per gallon tax on gas and the 3685 cents. With the agencys delay in processing tax returns trying to register for a new direct deposit account with your 2020 tax return wont get you into the system quickly enough.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Comparison based on paper check mailed from the IRS. What does the third stimulus check mean for US.

Latest Updates on Coronavirus Tax Relief Penalty relief for certain 2019 and 2020 returns. 1 online tax filing solution for self-employed. Was this article.

Check if you qualify for the Golden State Stimulus II. To qualify you must have. The third stimulus check is part of the 2021 American Rescue Plan Act ARPA a Coronavirus government relief package designed to provide further economic assistance to Americans struggling with the economic impacts of COVID-19The relief package includes direct 1400 payments to each.

Your eligibility for such payment and actual results may vary based on information you provide on your tax return. 1 online tax filing solution for self-employed. Americas 1 tax preparation provider.

A separate agreement is required for all Tax Audit Notice Services. Will elderly Social Security recipients receive a stimulus check. Richmond City Council in Virginia met to discuss allotting over 600000 in grants to preschool programs from the American Rescue Plan Act according to VPM News.

For this information refer to. Consult your own attorney for legal advice. Self-Employed defined as a return with a Schedule CC-EZ tax form.

A federal court ruled that qualifying incarcerated people are eligible to receive a federal stimulus check Economic Impact Payment or EIP under the Coronavirus Aid Relief and Economic Security Act CARES Act. The first payment of 1200 was sent in March 2020 followed by a check of 600 in December 2020. The full amount of the third stimulus payment is 1400 per person 2800 for married couples filing a joint tax return and an additional 1400 for each qualifying dependent.

Tax Audit Notice Services include tax advice only. Direct stimulus check payments grocery tax cuts and income tax rebates for their residents. The funds are from federal stimulus money sent to states during the height of the pandemic.

For more specific scenarios that could impact your eligibility visit Golden State Stimulus Help. If youve filed tax returns for 2019 or 2020 or if you signed up to receive a stimulus check from the Internal Revenue Service you will get this tax relief automatically. Amended tax returns not included in flat fees.

More information about identity verification is available on the sign-in page. Both IRS tools online and mobile app will show you one of three messages to explain your tax return status. Governor Phil Murphy announced a plan that would open the states coffers to provide more than 2 billion in rebates to approximately 2 million New Jersey households offering up to 1500 to families who pay property.

Line 17 on Form 540. Do you qualify for Stimulus.

.png)

California Golden State Stimulus Turbotax Tax Tips Videos

Where S My Refund Missouri H R Block

Value Added Tax Vat Definition

Never Got A Second Stimulus Payment Here S What To Do Next And Other Faqs Forbes Advisor

Trump Signs Covid Relief Bill 600 Stimulus Checks Go Out This Week

2020 Review Of Professional Tax Preparation Systems

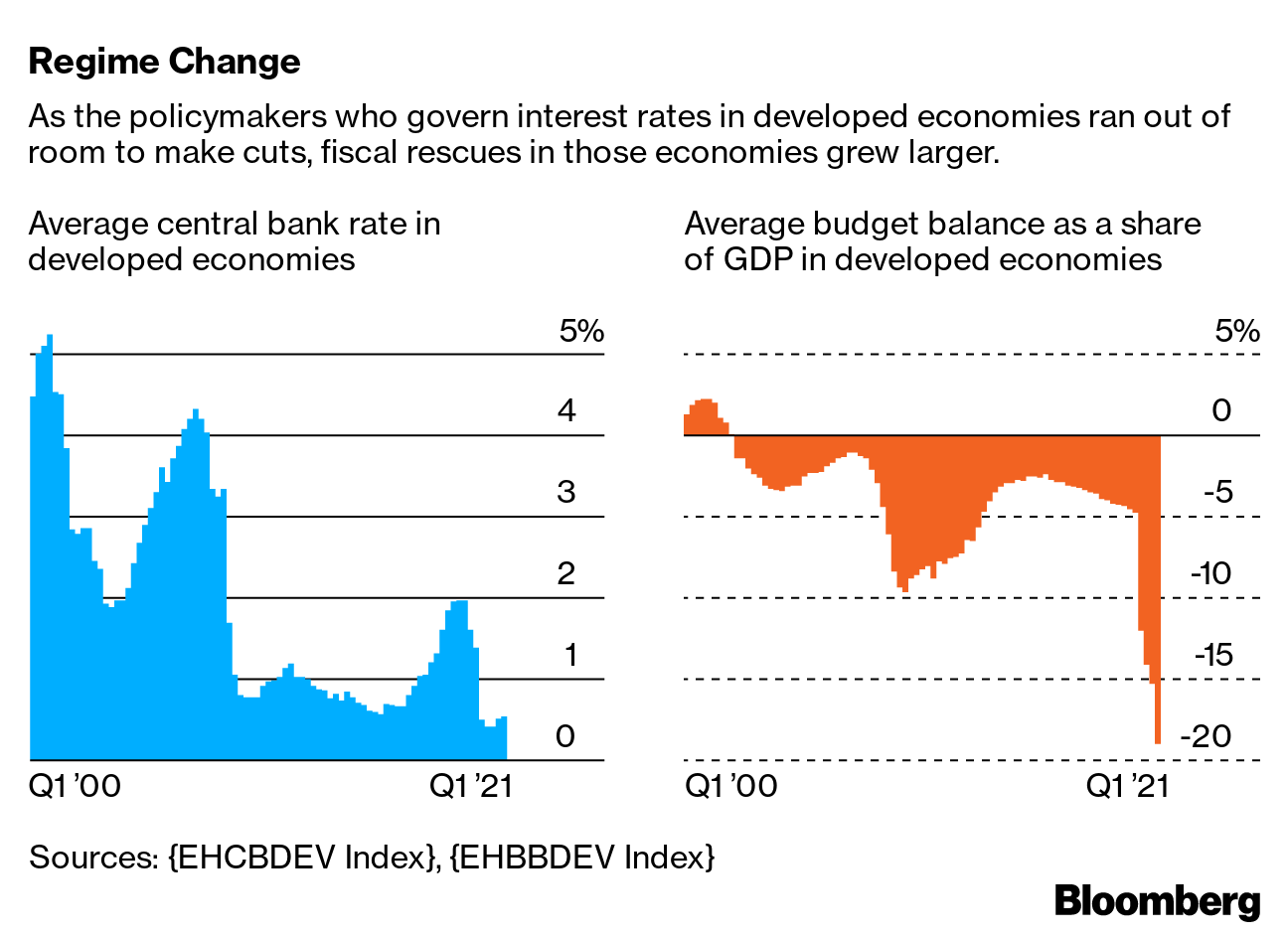

Stimulus Checks 2021 Is Government Cash As Economic Policy Here To Stay Bloomberg

What Is The Additional Child Tax Credit Turbotax Tax Tips Videos

Stimulus Checks 2021 Is Government Cash As Economic Policy Here To Stay Bloomberg

Taxact Review 2022 A Frugal Tax Filing Option

6 Tips To Get A Head Start On Your 2020 Tax Return Forbes Advisor

A Beginner S Guide How To File Taxes

Track Your Stimulus Check This Way

6 Tips To Get A Head Start On Your 2020 Tax Return Forbes Advisor

Video Are Bonuses Included In Adjusted Gross Income Turbotax Tax Tips Videos

Tax Deadline 2022 What Happens If You Miss The Tax Deadline Marca